To begin with elastic supply tokens, we need to know why there was ever a need for them and the sector they belong to, i.e., Decentralized Finance.

The Decentralized Finance (DeFi) ecosystem is evolving with each passing day as people interact freely in a peer-to-peer fashion without the requirement of an arbitrator, permissions, trust in each other, and putting their money into strange hands, such as central banks.

The blockchain-powered decentralized financial services get governed on the set of codes known as smart contracts, which plenty of times allow people to have a passive income by yield farming — essentially a staking protocol wherein lending crypto helps you earn crypto as a fee for your generosity.

With the pool of money, flash loan borrowing also becomes relatively easy, without any collateral.

It is almost like you ask somebody for crypto assets, use them for whatever purpose you deem fit, slide the profit into your pocket and repay the loan. However, if there is ever a loss, the transaction never did happen at all. The code written in smart contracts, usually on the Ethereum blockchain, takes care of that.

Now, all the belief around crypto as a replacement to fiat currencies is that the supply is fixed in most cases — like Bitcoin — there will never be more than 21 million BTC in total, and the block mining reward which stands at 6.25 BTC after 2020 halving will be further reduced to 3.125 in 2024 and 1.5625 in 2028. (4 years gap)

It helps keep the financial instruments scarce, thus propel the demand-frenzy, which drives the market upwards as everybody HODLs instead of cashing out.

In these volatile settings, people got the idea of creating stablecoins like Tether that get pegged against a fiat currency, usually a dollar, to keep its value stable.

Imagine, instead of pegging the crypto with a fiat currency, we could change the supply after a period to bring its value to the targeted price. This was the idea behind inventing elastic supply tokens — not eradicating volatility but minimizing it without depending upon any fiat asset.

What are elastic supply tokens?

Elastic supply tokens, also known as rebase or algorithmic tokens, work on the fundamental concept of demand and supply that when supply increases, the value of an asset comes down, and vice versa.

Rebasing is the process of changing the circulating supply to accommodate volatility, usually after 24 hours depending upon the Time-Weighted-Average-Price (TWAP).

Suppose you have 100 elastic supply tokens whose targeted value is $1 each. If the price goes up, the supply would also increase, which means that you will have more tokens in your wallet, but due to an increase in supply, their demand would come down — hence the price will start decreasing to reach the target rate. During the process, the percentage of overall supply you own will remain the same.

Conversely, with prices going down, the supply would decrease, which means that you will have fewer tokens that are individually worth more than before.

Is investing in elastic supply tokens a low-risk gamble?

No. Although they aim to mimic fiat-backed stablecoins, their change in pricing is pretty wild.

Ampleforth (AMPL)

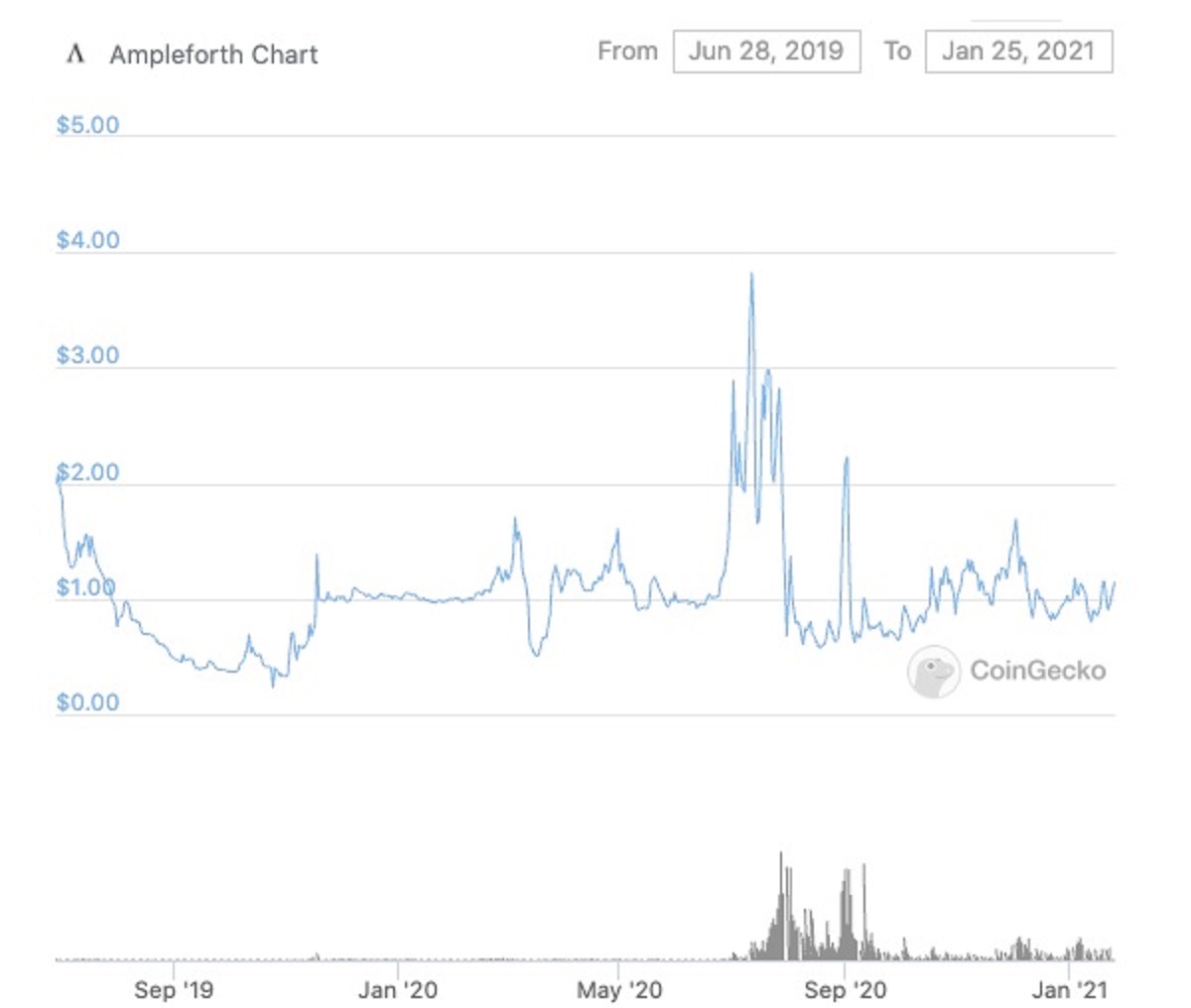

Check out the below data from CoinGecko about the Ampleforth (AMPL) elastic supply tokens v/s USD –

As it’s evident in the graph, the APML price, intended to be $1 for the lifetime, went from $0.22 to $3.83 in a short span of seven months thanks to the liquidity mining campaign known as Geyser —making it more popular than ever.

To put it in layman’s terms, you will earn big if the prices go skyrocketing; however, the other side of the token price is not at all amicable.

Making the matter even more exciting — there is an Ethereum-based token named Digg, which aims to mimic the price of BTC. Adding another drop to the pool filled with people latching onto the popularity of what many believe is the one-true-crypto-savior-of-all-time.

There are many other players in the rebasing space, such as

- Base Protocol (BASE)

- Yam Finance (YAM)

- DeFi 100 (D100)

Workings on a similar model, more or less; let us have a look at them –

Base Protocol

The BASE token considers the entire cryptocurrency market as one and is pegged at a ratio of 1:1 trillion of the collective market cap.

Truly one in a trillion and uniting the families of cryptos under one umbrella;

So, if the market cap is $1 trillion, its price would be one dollar. And in case the former reaches the milestone of $2 trillion, its price would double.

The idea behind all these elastic supply tokens is to create a synthetic asset whose price correlates with another asset(s) to moderate the supply to achieve the desired price.

Yam Finance

Yam Finance is an initiative backed by the community of Yan token HODLers who believe in the $1 target price, yield farming, and decentralized governance.

In the recent past, Yam achieved a value of 600 million dollars locked in its staking pools within two days before facing bugs in its rebasing mechanism that rendered more tokens than planned.

Ultimately, the community came together to fix the issues and relaunch the project — which is working seamlessly — as of today.

DeFi 100

The primary difference between Base protocol and DeFi 100 is that the former considers the entire crypto market, whereas the latter is concerned with only its league, the Decentralized Finance (DeFi) market.

DeFi 100 is pegged at 1:100 billion of the aggregate valuation of coins & tokens in the DeFi sector.

It is created on the Binance smart chain.

All of the elastic supply tokens that we had discussed so far offer a yield farming feature, allowing their holders to earn a passive income in other currencies or tokens by staking crypto assets into a pool.

Parting Thoughts

Getting more involved in the learning of the DeFi sector is a must before venturing into the new territory.

Sure, there are overnight millionaires, as we have seen with Doge, but the losers seldom get a mention.

The value proposition offered by rebase tokens is probably worth it, but its future is still under speculation as every nascent idea faces many hurdles before actually becoming promising.

So, if you are planning to build a project around them, then first consult with one of our blockchain experts. Call +1.844.3539.746 or email to: info@flexsin.com

Anurag Dutt

Anurag Dutt